Mutual funds have shown strong results as reliable investment vehicles for creating wealth throughout many years. But the question that often arises is, “How much do I have to invest to get ₹1 crore?” The 15*15*15 Rule in Mutual Funds represents a straightforward approach that enables additional investors to obtain their crore target. By following the 15*15*15 Rule in Mutual Funds, investors can achieve their financial goals more effectively.

What is the 15*15*15 Rule in Mutual Funds?

The 15*15*15 rule is a strategic investment aimed at guiding investors to build a corpus of ₹1 crore by following three simple steps:

The 15*15*15 Rule in Mutual Funds is not only a method of investing but also a transformative approach that can change your financial future.

- Invest ₹15,000 per month

- It’s been 15 years

- In a mutual fund offering a 15% annual return

This is why the 15*15*15 Rule in Mutual Funds should be considered by every aspiring investor.

Making steady contributions for several years allows collective funds to grow wealth steadily.

By applying the 15*15*15 Rule in Mutual Funds, you can take advantage of powerful compounding.

Understanding the 15*15*15 Rule in Mutual Funds can help demystify the process of wealth accumulation.

The Power of Compounding

The compound is often referred to as the “eighth wonder of the world.” Your investment starts producing income from its previous profits as a result. Your returns come from both your investing money and your profit made since the beginning.

Your ₹1,000 investment will grow to ₹1,100 when you earn 10% profit during year one. During your second investment period, you will receive 10% of the current value of ₹1,100. Your investment value expands more rapidly as you continue to invest your accumulated profits from previous years.

How Does Compounding Work?

Let’s break it down further:

Initial Savings: You make an initial investment, say ₹15,000 per month.

Return on investment: Over time, your income will start to yield higher returns.

Exponential Growth: The amount of time you give your investment and therefore your return increases due to compounding.

The sooner you start investing, the more time you have to scale and grow.

How to Invest in the 15*15*15 Rule in Mutual Funds?

To implement the 15*15*15 rule, you need to follow these steps:

Choose the right mutual fund: Select a mutual fund that shows a solid history of delivering strong investment results. fairness common finances, specifically those focused along large-cap or mid-cap pillory, historically delivered returns of 12-15% per annum across the past term

Start sips (systematic investing plans): investment ₹15000 done each month sips Makes about good results. Through a SIP, you can make recurring deposits of a set amount on your selected schedule. away spread investments across sentences you get less your photo to capricious grocery swings

Stay invested for 15 years: The magic of compounding builds over time. You build greater financial success by following your investment schedule and avoiding withdrawing funds before your intended time frame. If you want to experience compounding, you need to invest for 15 years in a row.

Check periodically: You should review your SIP investments twice a year, even though it stands as a long-term financial plan. You can replace your fund investment if the first one shows weak performance and has poor growth expectations.

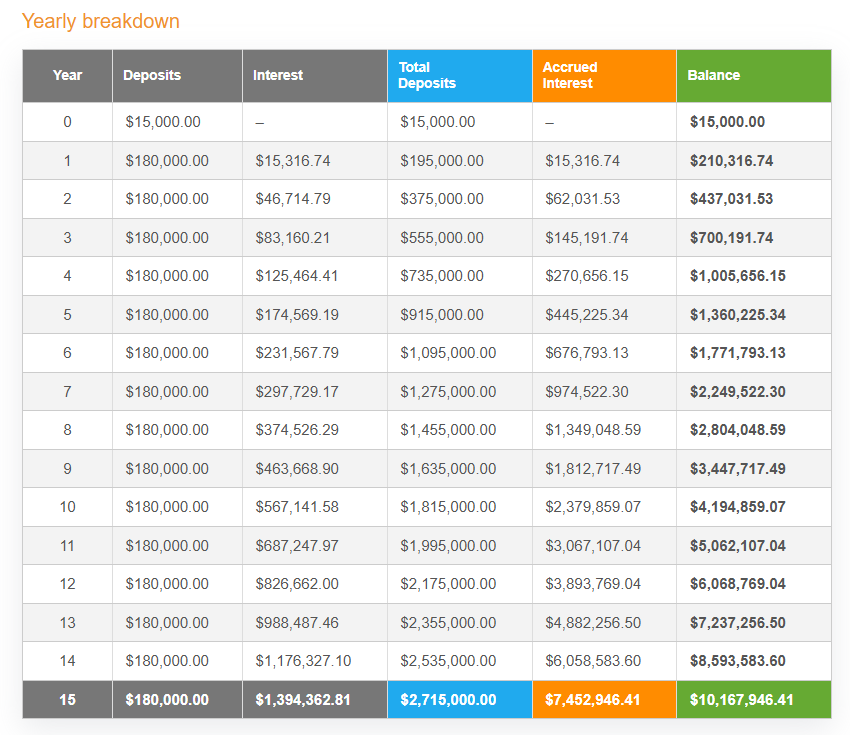

Example: How the 15*15*15 Rule Works in Action

Let’s consider an example:

- Monthly Investment: ₹15,000

- Investment Duration: 15 years

- Expected Annual Return: 15%

Using the 15*15*15 Rule in Mutual Funds, if you invest ₹15,000 a month for 15 years in a mutual fund that gives an annual return of 15%, your investment will significantly increase, potentially reaching ₹1 crore.

Here, however the mathematics works:

- Monthly sip: ₹15000

- Total investing across cardinal years: ₹15000 cardinal cardinal months cardinal cardinal age = ₹2700000

In conclusion, the 15*15*15 Rule in Mutual Funds is a powerful strategy that enables investors to build substantial wealth over time.

value of investing subsequently cardinal age (assuming 15% returns): ₹9987216 (close to ₹1 crore)

This illustrates how regular investments in a good mutual fund, coupled with the power of compounding, can help you achieve significant wealth over the long term.

Top 10 Best Trading Apps in India 2025

Conclusion

The 15*15*15 investment code helps you build ₹1 crore wealth with minimal effort. With consistent ₹15,000 monthly investments in a mutual fund that generates 15% interest per year and compounding growth, you will achieve significant wealth in 15 years. This method can work for anyone who has the discipline and patience to let time work its magic!

FAQs

1. Can I withdraw before 15 years?

You should keep your money invested for all 15 years to get the highest returns, but you can take your savings out at any point during that period. Pulling out funds early in the plan minimizes returns due to time constraints on possible growth.

2. Can the 15*15*15 rule be used for other financial goals?

By starting now and adhering to the 15*15*15 Rule in Mutual Funds, you can pave the way for financial success.

You can apply Act 15*15*15 to reach multiple financial targets, including purchasing a house and paying for your child’s education expenses. Your investment selection directly affects how much return you will achieve.

3. Is a 15% return realistic?

Equity mutual funds consistently achieve returns between 12% and 15% when investors hold their investments over the long term. Past investment performance supports a 15% return when you invest in the right fund type.

4. What if I can’t invest ₹15,000 monthly?

Start with any amount of money you can afford to invest today and grow it toward saving ₹15,000 monthly. The key is to invest regularly to be consistent.

Pingback: Denta Water and Infra Solutions Limited IPO Details - CashFN