Introduction: A credit score is a three-digit figure that indicates your creditworthiness or likelihood of repaying a loan. It is computed using variables such as credit utilization, duration of credit history, credit mix, payment history, and recent queries. Greater creditworthiness is indicated by higher credit scores, which normally range from 300 to 850.

The first step in opening up new financial options is knowing how to raise your credit score. Better odds of getting approved for rental applications, reduced interest rates on credit cards and loans, and even possible insurance premium reductions are all possible outcomes of Improving Your Credit Score.

What is a Credit Score?

A credit score is a numerical rating, typically ranging from 300 to 850, that reflects an individual’s creditworthiness. It helps lenders assess the likelihood of timely debt repayment. Credit scores are calculated using data from your credit report and are influenced by key factors: payment history (35%), credit utilization (30%), length of credit history (15%), credit mix (10%), and new credit inquiries (10%). Paying bills on time, maintaining low credit card balances, and having a diverse credit portfolio positively affect your score. A higher credit score improves access to loans, better interest rates, and other financial opportunities.

Why a Good Credit Score Matters?

Having a high credit score is important since it makes it easier to get credit cards, loans, and lower interest rates. Over time, it can save you money by providing better terms. Understanding how to improve credit score through on-time payments and minimal credit utilization can greatly increase credit score, opening up more favorable financial options and enhancing overall financial well-being.

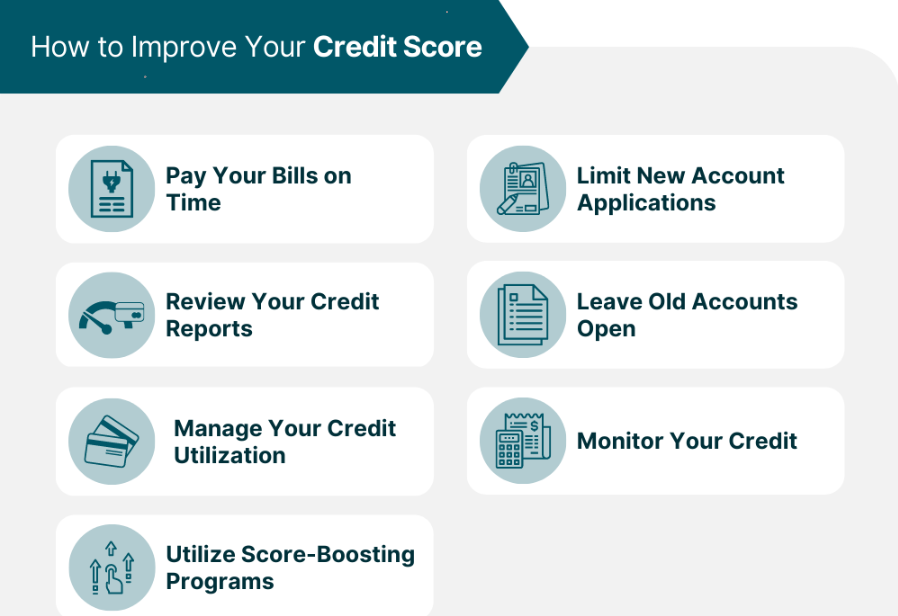

Proven Ways to Improve Your Credit Score

Reducing credit card balances, avoiding opening too many new credit accounts, and making on-time bill payments are all tried-and-true strategies to raise your credit score. Your score can also be raised by fixing mistakes on your credit record and maintaining a low credit use rate (below 30%). A stronger credit history can also be achieved by keeping older accounts open and preserving a variety of credit kinds.

Tips to Improve Your Credit Score Quickly

The following advice will help you raise your credit score more rapidly:

1. Pay your bills on time: Improving your score quickly depends on timely payments.

2. Lower Credit Card Balances: To lower your credit utilization percentage, pay off high-interest debt.

3. Look for Errors: Examine your credit report for errors and file a dispute if necessary.

4. Become an Authorized User: Get a person with a solid payment history added to your account.

5. Limit New Credit Applications: Refrain from requesting new credit because doing so can lower your credit score.

Common Mistakes to Avoid When Building Credit

Steer clear of these typical errors when establishing your credit:

1. Missing Payments: Your credit score might be negatively impacted by late payments. To raise your score, always make your bill payments on time.

2. Maxing Out Credit Cards: Your credit score is adversely affected by high credit utilization. To improve your score, keep your balances low.

3. Opening Too Many Accounts: Your credit score may suffer if you make too many credit queries. Don’t apply for new credit too often.

4. Closing Old Accounts: Reducing the length of your credit history can have an impact on how you raise your credit score.

5. Ignoring Your Credit Report: Verify your credit report frequently for mistakes. Faster credit score growth is achieved by disputing errors.

Long-Term Habits for Maintaining a Good Credit Score

For long-term success, maintaining a high credit score necessitates timely bill payment, minimal credit utilization, frequent credit monitoring, credit diversification, and avoiding excessive new credit applications.

Conclusion

In conclusion, raising your credit score requires commitment and time, but it is possible if you use the appropriate techniques. You can successfully raise your credit score by regularly making on-time bill payments, cutting debt, and keeping an eye on your credit. Keep in mind that knowing how to raise your credit score through responsible spending practices can open up more favorable financial options and result in cheaper borrowing expenses down the road.

FAQs About Credit Scores

What is the fastest way to improve credit score?

Reducing large credit card debt and making on-time payments are the quickest ways to raise your credit score. Avoid new credit inquiries, lower credit utilization, and check your credit report for inaccuracies if you want to raise your credit score fast.

How often should I check my credit report?

To ensure accuracy and identify any potential problems, you should review your credit report at least once a year. However, if you’re actively managing or increasing your credit, it’s best to check it more frequently, like every three months. Frequent monitoring makes it easier to spot problems early on, such as fraudulent activity or inaccurate information, so you can take quick action to fix them and preserve your credit score.

“Can I improve my credit score in a month?

Your current circumstances will determine how much your credit score improves, but it is possible to do so in a month. Paying off large credit card debt, challenging inaccuracies on your credit report, and making sure all bills are paid on time will all help you see improvements quickly. These steps can help you make apparent progress in as little as one month, but significant changes typically take longer.

Get more details by watching this video.