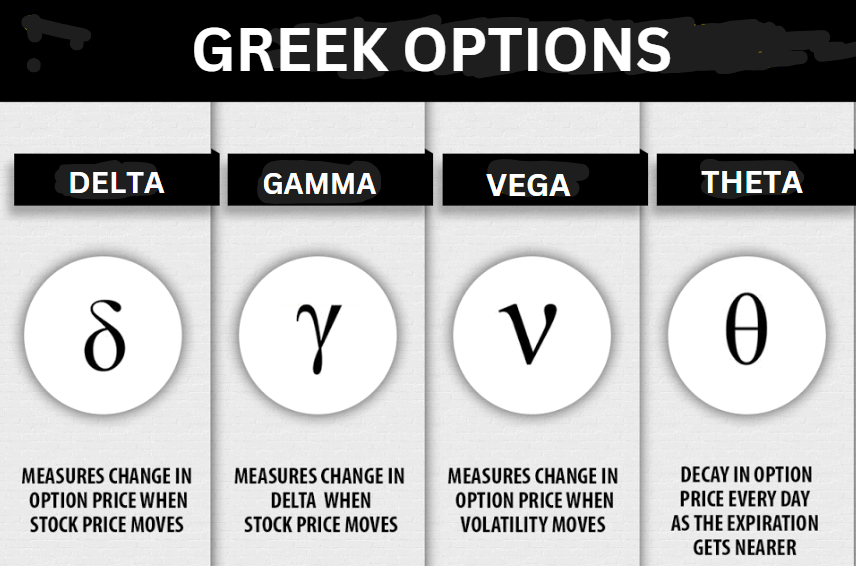

Among the intricate trading strategies, options trading necessitates taking into account the following factors when figuring out an option’s pricing. One of the aspects mentioned is “Greek marketing,” which refers to a set of instruments useful for identifying possible hazards and choices that impact traders. This symbol is composed of the Greek letters delta (Δ), gamma (Γ), theta (θ), and vega (v). In the sections that follow, we will explain these Greek words to help you better appreciate their value in option trading.

Delta: Sensitivity to Price Changes

For each dollar that the price of the underlying asset fluctuates, Delta is compelled to report the anticipated change in the price of an option.

- Call Options: Delta ranges from 0 to +1. The option’s price should rise by ₹0.60 if the price of the underlying asset rises by ₹1, for example, if the symbol shows that the option’s delta is +0.6.

- Put Options: Delta ranges from 0 to -1. A delta of -0.4 means that for every ₹1 increase in the value of the underlying asset, the option’s price will fall by 40 cents.

Key Insights:

- Sometimes, delta can also refer to the probability that an option will expire in the money.

- When hedging positions, those with absolute delta values use them. For example, a short position with an opposing delta of -1 can be used to hedge a portfolio with a delta value of +1.

Gamma: Sensitivity of Delta

In essence, gamma calculates the delta change per unit change in the price of the underlying asset whenever it is evaluated at ₹1. Gamma provides the definition of how delta will alter in response to changes in the price of the underlying asset.

- Consequently, at-the-money options close to the expiration date have high gamma values.

- If the futures price is far in or out of the money, these are signs of low gamma.

Key Insights:

- In particular, a high gamma analysis indicates that the option is sensitive since the delta can fluctuate greatly in response to slight changes in the price of the underlying assets.

- When trading delta-neutral accounts, traders keep a close eye on gamma since volatility can result in an unanticipated directional movement.

Theta: Sensitivity to Time Decay

Theta is the rate at which the value of an option declines over time, assuming that no other factors change. Because options have a time limit, their value declines as the period leading up to their expiration passes.

- Call and Put Options: Since the option value falls over successive time periods, theta is often negative for European-style options.

- Theta, which is another name for the rate of time decay, indicates that the closer an option is to expiration, the greater the theta number.

Key Insights:

- Compared to long-term options, theta is higher for short-term options.

- Theta is another element that has to do with normal usage; dealers that offer options like cash secured put or covered call will benefit from the time decay factor.

Vega: Sensitivity to Volatility

Vega consistently indicates how much an option premium’s value will fluctuate in response to a one basis point change in the underlying asset’s implied volatility.

- Generally speaking, higher implied volatility levels lead to higher call and put option prices.

- Vega reaches its greatest at the money and decreases when the option’s value rises or falls.

Key Insights:

- Traders frequently employ options to profit from the additional value in these options premiums if volatility is predicted to rise.

- On the other hand, traders might take advantage of the decline in premium by selling options when volatility seems to be diminishing.

How to use the Greeks in Option trading

Understanding the Greeks and being able to use them effectively can make risk management easier and increase traders’ profits. Here are a few useful applications for them:

Delta for Directional Trades: To determine the directional exposure of their positions, traders employ delta. Bullish exposure is indicated by a large positive delta, and bearish exposure is indicated by a high negative delta.

Gamma for Risk Management: Traders keep an eye on gamma to avoid being caught off guard on the wrong side of a directional move in the position, since it signifies the speed of delta.

Theta for Income Methods: Traders that use income stream methods, like selling a covered call with a cash secured put, should pay special attention to theta. On the basis of temporal decay, they attempt to construct the model.

Vega for Volatility Trades: Traders can utilize vega to adjust their positions in response to shifts in market volatility. When volatility is predicted to increase, it is better to buy options; when volatility is predicted to decrease, it is better to sell options.

Conclusion

Four metrics—delta, gamma, theta, and vega—are essential to option trading and help traders accurately evaluate risk. Traders can adjust their methods, position hedges, and returns by studying each Greek and how it affects the price of options. The use of the Greeks could simply improve the trade analysis for both inexperienced and seasoned traders.

Putting that knowledge to use will set one up for long-term success as an options trader. Things like always keeping a pen and paper nearby, remembering that there is always more to learn and keeping an eye on market circumstances and how they could impact your holdings are all examples.