Explore the Best Trading Apps in India with our in-depth reviews, features comparison, and expert insights.Your ability to succeed in the current volatile markets depends on the trading app you use. All traders, regardless of skill level or preference for ease of use, can benefit from these top trading applications. With the advent of smartphones and the development of technology, trading has grown in popularity among Indians as a means of investment in recent years. By enabling users to invest in a variety of financial instruments, trade while on the go, and keep up with market developments, trading applications have completely transformed the stock market.

You may discover, evaluate, and improve your financial path with the aid of the top trading apps.

Zerodha Kite: Kite is one of the most popular trading apps in India, Zerodha Kite has over 7.5 million active users. All levels of traders and investors can benefit from its user-friendly interface and robust features.

Features

- Advanced Charting: that include more than 90 technical indicators, a variety of periods, and charts that may be customized for in-depth examination.

- Seamless Navigation: A hassle-free trading experience is guaranteed with a clear and intuitive interface.

- Third-Party Integration: Make use of resources such as Smallcase for portfolio construction, Sensibull for options trading, and others.

Offers and Fees

Zero Brokerage: No costs on equity delivery trades.

Flat ₹20 Per Order: For intraday, F&O, and currency trading, irrespective of trade size.

Periodic Promotions: Free account registration when there are exclusive deals.

Pros:

- Inexpensive trading with an open fee schedule.

- Strong third-party integrations and tools.

- A sizable user base and widespread trust.

Cons

- Limited avenues for consumer service.

- Does not provide thorough research reports for novices.

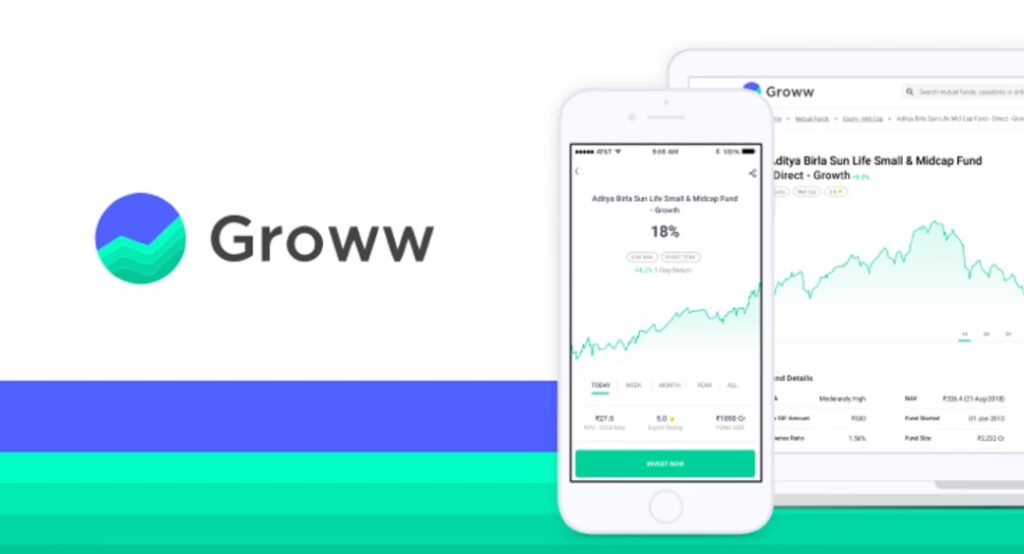

Groww: With more than 13 million active members, Groww is one of the trading platforms in India with the quickest rate of growth. Its unique features and user-friendly design, which appeal to both novice and experienced investors, are the main reasons for its success.

Features

- Ease of Use: streamlined user interface for smooth navigation.

- Diverse Investment Options: Stocks, mutual funds, ETFs, and more.

- Smart Insights: data on stock performance and real-time analytics.

- Mobile Accessibility: accessible for trading while on the go on iOS and Android.

Offers and Fees

- Account Opening: Demat and trading accounts are free.

- Brokerage Charges: For intraday and F&O, the penalty is ₹20 or 0.05% of each executed order, whichever is less.

- Mutual Fund Investments: Direct mutual funds do not have any commission.

Pros:

- Direct investments in mutual funds without a commission.

- Easy-to-use program that is appropriate for novices.

- Clear costs and prices.

Cons:

- Professional traders have limited access to sophisticated technologies.

- No specific client support hotline.

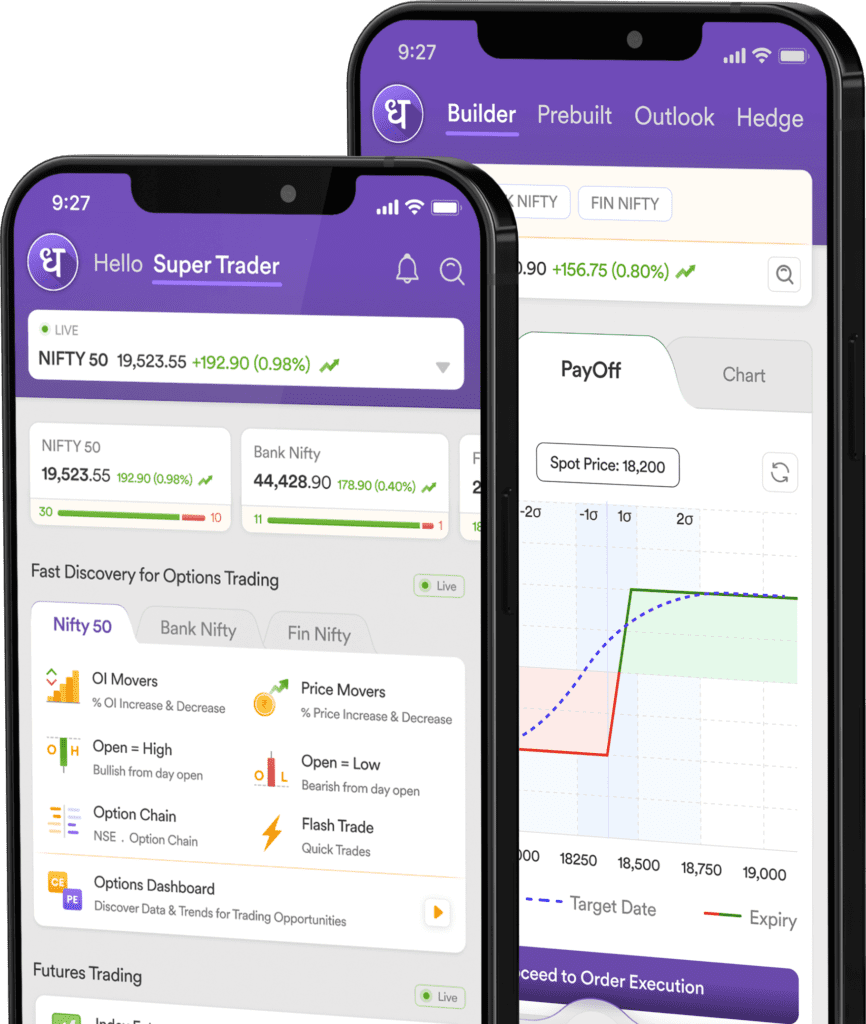

DHAN: With more than 7.5 million active users, Dhan is quickly becoming popular among Indian traders. It stands out in the trading scene due to its emphasis on providing traders with state-of-the-art tools.

Features

- Advanced Charting Tools: TradingView charts are included for in-depth research.

- One-Click Order Placement: makes stock, option, and futures trading easier.

- Custom Watchlists: Monitor your preferred stocks and indexes in real time.

- Basket Orders: Execute your approach by placing several trades at once.

- Direct Investment Options: Trade commodities, equities, ETFs, and initial public offerings.

Offers and fees

- Account Opening: Demat and trading accounts have no costs.

- Brokerage Charges: 0.03% for F&O and equities trading, or ₹20 per order.

- Subscriptions: Use premium tools with membership plans that are optional.

Pros:

- Sophisticated instruments for technical analysis and strategy implementation.

- Quick order fulfillment with little latency.

- Competitive brokerage costs combined with clear pricing.

Cons:

- Lacks options specifically for investing in mutual funds.

- Beginners may find the higher features bewildering.

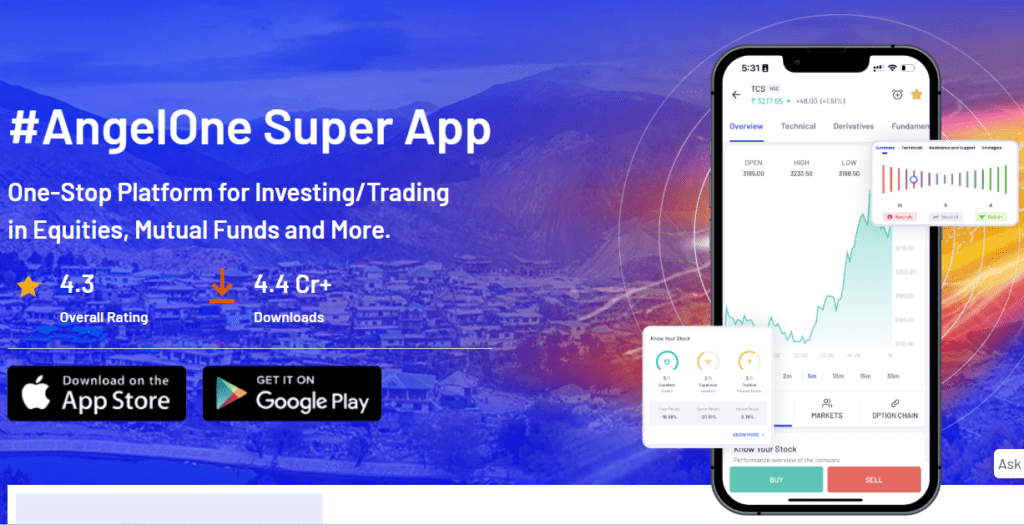

Angel One: With more than 10 million active users, Angel One is a popular option for traders and investors in India. It has gained considerable confidence due to its reputation for innovation and dependability.

Features:

- ARQ Prime: AI-powered stock recommendations for more intelligent financial decisions.

- SmartAPI: permits third-party connectors and automated trading.

- Diverse Investment Options: comprises IPOs, commodities, stocks, mutual funds, and currencies.

- Advanced Charting Tools: Comprehensive technical analysis capabilities.

- Market Insights: To make well-informed selections, consult research papers and trading tactics.

Offers and Fees:

- Account Opening: For the first year, it is free.

- Brokerage: Delivery of equities is free; intraday and F&O orders cost ₹20 each.

Pros: Zero brokerage on delivery trades, easy-to-use UI that is appropriate for novices,sophisticated instruments for seasoned traders.

Cons: Subscription is required for premium features.occasional problems with the app’s performance.

Upstox: Among India’s top trading platforms, Upstox boasts more than 10 million active members. Investors and traders alike favor it because of its cutting-edge features and competitive pricing.

Features

- Advanced Trading Tools: Get technical analysis, charts, and indicators in real time.

- Investment Options: Trade in stocks, derivatives, mutual funds, and IPOs.

- User-Friendly Interface: Easy navigation makes trading hassle-free.

- Instant Account Opening: Paperless sign-up process.

- Free Educational Resources: Use webinars and manuals to learn how to trade.

Offers & Fees: Upstox provides cheap fees for intraday and F&O transactions, starting at ₹20 per order, and 0% brokerage on equities delivery. New customers often enjoy promotional incentives like free Demat accounts.

Pros:

- Reasonably priced brokerage costs.

- A great trading platform that allows extensive customization.

- 24/7 client service available.

Cons:

- The app occasionally delays during busy times.

- restricted bank collaborations for money transfers.

Fyers: With more than 500,000 active investors, the Fyers Trading App is a well-liked platform among Indian traders. Both novice and experienced traders can benefit from its user-friendly design and sophisticated features.

Features

- Advanced Charting Tools: Get access to more than 65 indicators and editable charts to help you make wise choices.

- Multi-Platform Integration: Trade with ease on desktop, mobile, and web platforms.

- Thematic Investing: For long-term growth, put money into carefully curated portfolios.

- Free API Access: Use API connectors to automate transactions.

Offers and Fees: Fyers offers flat brokerage costs of ₹20 per executed order and no account opening fees. Equity delivery trades are also totally free, which makes it an affordable option.

Pros: distribution of free equity.

Thematic investments and sophisticated trading instruments.No unstated fees.

Cons: No direct investments in mutual funds.

limited avenues for consumer service.

5paisa: The 5paisa Trading App is a popular option for traders and investors on a tight budget, with over 3 million active users. It provides a feature-rich, easy-to-use platform that is appropriate for users of all skill levels.

Features

- Zero Brokerage Plans: Trade with set subscription plans at extremely low prices.

- Smart Investor Tools: Get research reports, stock recommendations, and robo-advisory.s.

- Multi-Asset Investment: Trade in stocks, mutual funds, ETFs, and more.

- User-Friendly Interface: seamless online and mobile trading experience.

Offers and Fees: Get account opening at just ₹0 and trade with brokerage as low as ₹20 per order. Monthly subscription plans start from ₹399.

Pros: Low-cost brokerage plans. Advanced research tools. Comprehensive investment options.

Cons: limited use of sophisticated charting.

Certain features come with extra fees.

ICICI Securities: The ICICI Securities Trading App is a reliable option for both new and seasoned traders because it serves a sizable user base in India. The app has a strong and intuitive user interface and has over 2 million active users.

Key Features

- Real-Time Market Data: Get up-to-date stock quotes, charts, and in-depth market research.

- Diverse Investment Options: Trade ETFs, equities, mutual funds, and initial public offerings.

- Advanced Research Tools: To make wise choices, apply both technical and fundamental analysis.

- Seamless Integration: Connect your accounts to ICICI Bank to facilitate simple transaction.

Offers & Fees: With zero fee on equity delivery trades and cheap brokerage on other sectors like intraday and F&O, ICICI Securities provides competitive pricing. Order fees start at ₹20. Promotions and special incentives, like free Demat accounts, are frequently advantageous to new users.

Pros: strong security and high brand trust. Several different investment choices. Great customer service and an easy-to-use interface.

Cons: higher costs for those who do not use ICICI Bank. Sporadic technological issues during volatile markets.

Kotak Neo: The Kotak Neo Trading App caters to a growing base of active users in India, offering a secure and feature-rich trading experience. With over 2 million active users, this app is trusted by investors of all levels.

Features:

- Advanced Trading Tools: charts, technical analysis, and real-time market data to help traders make wise choices.

- Diverse Investment Options: Trade in derivatives, IPOs, mutual funds, equities, and exchange-traded funds (ETFs).

- Seamless Integration: Connect to Kotak Mahindra Bank to make transactions easy.

- Educational Resources: access to market insights, video courses, and research studies to improve trading expertise.

- User-Friendly Interface:Features that can be easily customized and navigated for a customized trading experience.

Offers & Fees: With no commission on equity delivery deals, Kotak Mahindra provides cheap brokerage costs. Intraday and F&O trade fees start at ₹20 per order. Offers like free Demat accounts and reduced trading fees are available to new users.

Pros: dependable and safe trade environment. Several different investment choices. Outstanding customer service and instructional materials.

Cons: higher fees for clients who do not use Kotak Mahindra Bank.

occasional problems with the app’s performance during periods of high trading volume.

AliceBlue: The AliceBlue Trading App is a well-liked option for Indian traders because it provides a thorough and intuitive platform for easy trading and investing. The program offers access to a variety of financial assets, such as equities, commodities, and derivatives, and has an increasing number of active users.

Key Features: Real-time market data, sophisticated charting tools, technical analysis, and order execution choices are just a few of the many features that the program offers. Additionally, it provides a safe environment with two-factor authentication and supports a variety of order kinds.

Offers and Fees: Both novice and experienced traders can afford AliceBlue’s competitive price and flat brokerage charge structure. To help users save money, the app provides a number of promotional incentives, such as lower brokerage rates and rewards on trading volumes.

Pros: For users include an easy-to-use interface, dependable customer service, and a speedy account opening procedure. The extensive library of educational materials on the app aids traders in honing their techniques and abilities.

Cons: The software occasionally lags during periods of severe market volatility, according to some customers. Furthermore, in contrast to other well-known trading platforms, it could not have all the sophisticated features.

FAQs

What are the top trading apps in India for 2025?

Ans: As of 2025, Zerodha, Upstox, AliceBlue, 5paisa, HDFC Securities, ICICI Direct, Kotak Securities, Angel One, Paytm Money, and Groww are the leading trading applications in India.

Is Dhan a safe app?

Ans: Dhan is a trading platform governed by SEBI and a Depository Participant (DP) that complies with all laws and guidelines.

Which trading app has more than 4 rating?

Ans: groww is 4.7 rating app

Best trading app for beginners

Best Mutual Fund Apps in India 2025: Manage Your Portfolio Anytime, Anywhere